what is the property tax rate in ventura county

Find Information On Any Ventura County Property. This is the total of state and county sales tax rates.

The Property Tax Inheritance Exclusion

In addition the property tax rates for particular portions of a city may differ from what is above due to specific Tax Rate Area.

. Thousand Oaks includes Newbury Park and Ventura area of Westlake Village 10400. Californias overall property taxes are below the national average. The average effective after exemptions property tax rate in California is 079 compared with a national average of 119.

The minimum combined 2020 sales tax rate for Ventura County California is 725. This is the total of state and county sales tax rates. Californias overall property taxes are below the national average.

The Property Tax Rate for the City and County of San Francisco is currently set at 11880 of the assessed value for 2014-15. What is the property tax rate in Ventura County. Tax description Assessed value Tax rate.

All forms must contain a photocopy of an original signature. The assessed value is initially set at the purchase price. What is the property tax in Thousand Oaks CA.

Uni SCH Bond Oakpark 3. All emailed material must be from the owner authorized agent CPA or an officer of the organization. By Mail - Mailing address is - Homeowners Exemption Section The Ventura County Assessors Office 800 South Victoria Avenue Ventura CA 93009-1270.

Ventura County collects on average 059 of a propertys assessed fair market value as property tax. Thousand Oaks Newbury Park and Westlake. A phone number must be included for verification purposes.

The median property tax on a 56870000 house is 597135 in the United States. Ventura County collects relatively high property taxes and is ranked in the top half of all counties in the United States by property. The median property tax in Ventura County California is 3372 per year for a home worth the median value of 568700.

Tax Rate Database - Ventura County. 10400 City Property Tax Rate Thousand Oaks includes Newbury Park and Ventura area of Westlake Village 10400 Westlake Village LA. Prop 13 Maximum 1 Tax.

In Person - Visit the Assessors Office at the County Government Center. What is the real estate tax in California. The combined 2020 sales tax rate for Ventura County California is 725.

The median property tax on a 56870000 house is 420838 in California. Please note that the above Property and Sales tax rates are subject to change and may have changed since publication. Its probably safe to assume that the actual tax rate for each area will be closer to 125 give or take.

Uni SCH Bond Oakpark 2. Uni SCH Bond Oakpark 4. This calculator can only provide you with a rough estimate of your tax liabilities based on the.

Additionally how much is the property tax in California. Our fax number is 805 645-1305. The median property tax also known as real estate tax in Ventura County is 337200 per year based on a median home value of 56870000 and a median effective property tax rate of 059 of property value.

County 11063 Agoura Hills 11063 Oak Park 11642. The average effective property tax rate in California is 077 compared to the national rate which sits at 108. The property tax rate is 1 of the assessed value plus any voter approved bonds fees or special assessments.

The assessed value is. Tax Rates and Info - Ventura County. The Property Tax Rate for the City and County of San Francisco is currently set at 11880 of the assessed value for 2014-15.

The median property tax on a 56870000 house is 335533 in Ventura County. Ad Need Property Records For Properties In Ventura County. The Ventura County sales tax rate is 025.

Ventura County has one of the highest median property taxes in the United States and is ranked 123rd of the 3143 counties in order of median property taxes. The California state sales tax rate is currently 6. Ad Uncover Available Property Tax Data By Searching Any Address.

The Ventura County sales tax rate is 025. We Provide Homeowner Data Including Property Tax Liens Deeds More. Revenue Taxation Codes.

SEE Detailed property tax report for 5796 Freebird Ln Ventura County CA.

Property Tax By County Property Tax Calculator Rethority

Pin By Socially Savvy On Pacific Coast Title Cfpb Training Day Finding Yourself Closing Costs Training Day

Pay Property Taxes Online County Of Ventura Papergov

Ventura And Los Angeles County Property And Sales Tax Rates

When We Reach Retirement Age A Lot Of Us Plan To Move To That Dream State We Always Pictured Ourselves Growing Old Gas Tax Healthcare Costs Better Healthcare

Lansner Hiring May Boost Housing Outlook House Prices Housing Market Mortgage

Property Tax California H R Block

California Government Benefitting From Rising Property Values Low Rates And Higher Home Values Increase Property Tax Collections Who Pays Tax Bill On Foreclosed Properties Dr Housing Bubble Blog

States With The Highest And Lowest Property Taxes Property Tax States Tax

Minimize Property Taxes Ca Prop 60 90

Ventura County Assessor Supplemental Assessments

Property Tax By County Property Tax Calculator Rethority

Ventura County Ca Property Tax Search And Records Propertyshark

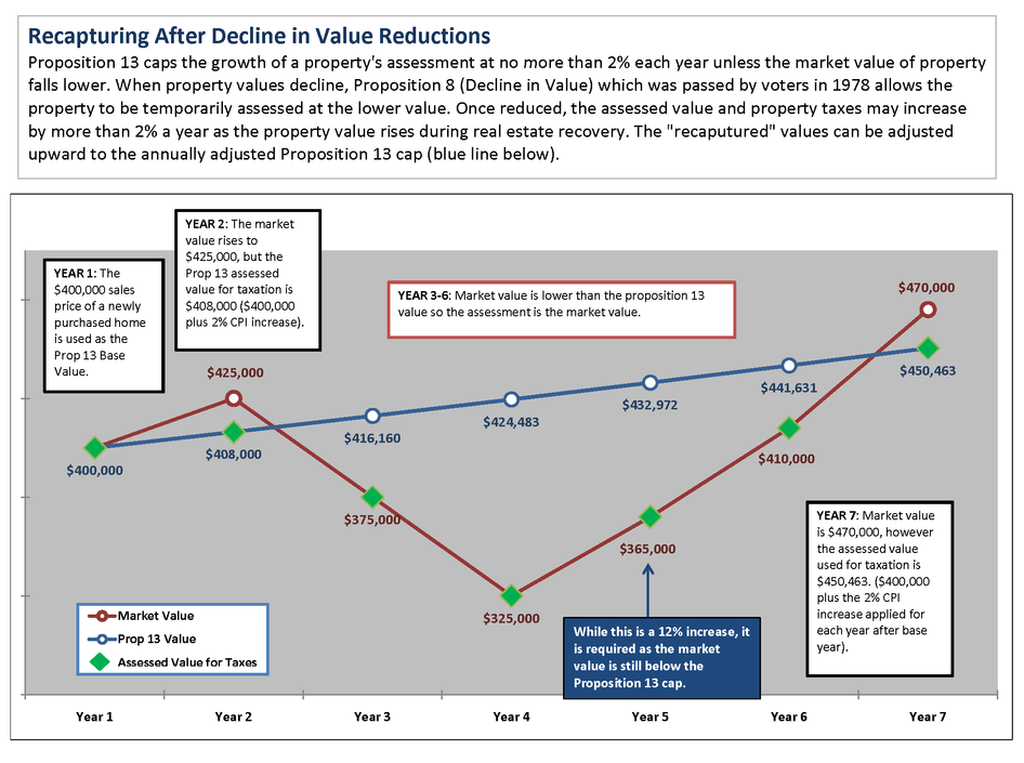

Prop 8 Decline In Value And Prop 13 Property Tax Limits Ventura County

Growing Out Of Control Property Taxes Put Increasing Burden On Illinois Taxpayers Property Tax Tax Property